Navigating Anxiety and Personal Finance: A Guide for Men

Men everywhere are stressed and anxious about money. I hear this all the time.

As a male mental health counselor in Greensboro and Winston-Salem, my male clients frequently discuss their anxieties surrounding money and their difficulty just paying their bills every month. When I’m not working, all of my friends and fellow dads also admit to carrying a weight around about finances that they feel unable to shake.

In this post, we'll explore practical strategies to find calm within ourselves and manage money stress effectively.

Breaking Down the Taboos: Men, Mental Health, Money

First, I want to acknowledge that discussing anxiety and money in the same post is to name two social taboos that are frequently not talked about in male culture.

Men are traditionally socialized not to show any vulnerability or weakness in front of others (which is to say - to be an actual human in front of others), and admitting to anxiety or financial concerns around others is to admit that you are human…which is something that men have been taught they should be ashamed of.

But here’s what I want you to hear:

You are not alone in your stress and anxiety about finances.

It may seem like your friends or relatives are not concerned about money. Maybe you have seen people around you doing some of the following:

Taking vacations you can not afford

Driving cars you can not afford

Buying houses you can not afford

Spending money on their children that you can not afford

Eating at restaurants or going to events you can not afford

After spending time in the confidential space of a therapist's office as a male counselor, I have found that many of the men engaging in those activities can’t actually afford them either. And, the ones that can, are still also very stressed about finances.

This article, which came out just last month, agrees with my assessment and cites that only one out of three adults feel financially secure in America right now. Furthermore, the article found that in order to feel secure, Americans need to make $233,000…which is three times the median household income in the United States.

What’s even more interesting, is that among households making over $100,000 - people say they need to make at least $341,000 to feel financially secure.

Check out the graphic from this article charting house price versus household income over time:

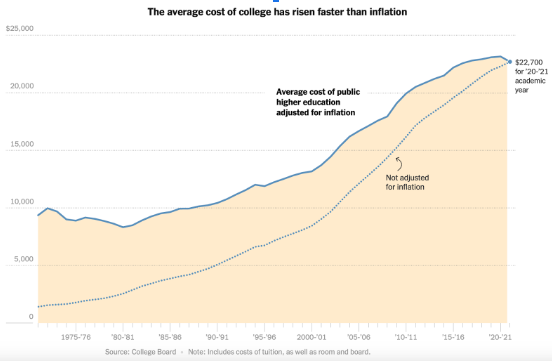

Or this article from the NY Times about changes in student loan debt and the rising cost of college tuition over time, which includes this key graph:

Again - you are not alone in your financial anxiety and financial struggles. These are large, systemic, nation-wide issues.

So…what can you do about it in your own life?

Here are 3 Things:

3 Ways to Address Anxiety about Money

The Budget Talk

Men can have one of two reactions (and sometimes both!) when they begin to realize that their own personal finances are affected by large national and global changes at play:

Some men feel a sense of relief that they are not unique f$*k ups, but that the economic pressure they feel is in fact affecting all of us.

Some men feel completely out of control, because they recognize that they do not have control over national/global financial changes and trends.

Both of those reactions make sense…and…part of where we can begin to find the ability to ground ourselves again, is to come back to what we all intuitively know is true, but sometimes forget along the way:

I am not responsible for and can not control the actions of others. I am responsible for my own actions.

I get a lot of the criticism of talk around budgeting, because often talks around budgeting make it sound like we are entirely the reason for our financial struggles…which isn’t the whole picture. As noted above, there are all kinds of large systems interacting and impacting us in ways that we can’t control.

But what is true, is that what we can control is that we really do get to choose what we do with the money that we have. Budgeting can be a mental health exercise in which we remind ourselves, “I get to do what I want with the money I make” (in collaboration with your partner, if you have one), and get really clear about what that looks like for you.

I’m not going to do a deep dive into the best budgeting tips or strategies or how all of that works. I am not a financial expert…that’s not my contribution here. But, creating a budget and sticking to it as closely as possible can actually be a really empowering, and anxiety reducing act.

2. Reducing Shame

I wrote about this in the first part of the blog, but again: you are not alone in your financial struggles.

Our culture has often given men the exclusive role of being responsible for the financial prosperity of their entire family. I hear these kind of phrases all the time in our culture - going to work as “bringing home the bacon”, closing a sale as “hunting”, or “killing to eat.” The belief in all of these statements is that it is the man, and the man alone’s role to provide for the family.

There’s too sides to every coin, and, tying your sense of worth to your ability to a certain size paycheck can feel really validating when you are making that size paycheck. But, when that’s not happening, it often fills men with shame that they’re failing at what they uniquely are “supposed” to be able to do.

Often the idea that is unstated when I work with men around financial shame is that what “providing for the family” actually means is, giving my children the middle class life that they grew up in. Which, can vary a great deal based on who I’m talking to, but, may include things for kids like:

Annual vacations

Extra curricular activities/hobbies/sports

Eating at restaurants

A certain size house

The unstated idea is often that if you can’t give your kids what your father gave you, you have failed.

I totally get that - and I have to admit I have that story rattling around in the back of my own mind as well. But…it’s just a story.

Here are three shame-busting statements I remind myself (and my clients) when financial shame starts to get noisy in my head:

My own parents lived in very different circumstances than I do.

My net worth is not my human worth.

What my kids need most of all is to feel safe, loved, and seen.

That third point is something we can all work and grow towards, no matter what our income level or paycheck.

Healing Your Own Anxious Inner Child

Internal Family Systems (IFS), a counseling theory I draw heavily from, believes that within each of us are multiple parts. If you are anxious about finances, you likely have a younger part within you that felt anxious, scared, or unsafe earlier in life that your current financial anxiety is trying to help. That’s totally normal.

IFS also believes that every person also has within them a Calm, Connected, and Courageous part of themselves as well. (IFS calls it the Self, and technically, it’s not a part - it’s just - well - you).

Through counseling, you can actually access your own inner Calm and Courage and heal those younger parts of yourself that carry that fear and anxiety. You can let them know they are safe now, because you are with them.

When those younger parts are healed, they will no longer carry that fear and anxiety within you, and the part that is anxious about money will recognize that it no longer has to work so hard to protect those younger parts within.

When I read that statistic cited earlier about needing somewhere between $233,000 and $341,000 a year to feel financially secure, what I hear is - the vast majority of us are never going to make enough money to feel financially secure with our current mindsets. But while we may not make that amount of money to feel financially secure with our current way of thinking and being, we absolutely can find calm, courage, trust and peace about finances as we heal our inner parts through counseling.

Conclusion

One more time for the people in the back:

You are not alone in your struggles.

As a mental health counselor specializing in anxiety therapy and anger management for men, I am here to support you on your journey towards finding calmness within yourself and achieving financial peace.

Too many men do nothing and find themselves worrying about money, finances, stress, and anxiety for years. That doesn’t have to be you.

Wishing you the best on your mental health journey.

Hi, I’m Travis.

My clients describe me as calm, compassionate, and curious…

You have these qualities inside you at your core too. You just need a little help uncovering them.

If you’re dominated by anger, anxiety, shame, or self-criticism, we can help you re-connect with who you really are: confident, calm, courageous, compassionate, and connected to yourself and others.

Travis Jeffords - LCMHCA MDiv. | Male Counselor

In-person counselor: Greensboro & Winston-Salem

Virtual counselor: North Carolina

Licensed Counselor

Please note: The information provided in this blog is for general informational purposes only and is not a substitute for professional counseling or therapy. The content presented here is based on my professional knowledge, personal experiences and research, but it should not be considered as a replacement for individualized mental health advice.

Every individual is unique, and the content provided may not be applicable to everyone's specific circumstances. It is important to consult with a licensed mental health professional regarding your specific concerns and to receive personalized guidance tailored to your needs.